What is Encryption?

Encryption is the process of encoding information. This Encryption Process converts the original representation of the information, known as plaintext, into an alternative form known as ciphertext. The authorized parties can decipher a ciphertext back to plaintext and access the original information. Encryption does not itself prevent interference but denies the intelligible content to a would-be interceptor.

For technical reasons, an encryption scheme usually uses a pseudo-random encryption key generated by an algorithm. It is possible to decrypt the message without possessing the key but, for a well-designed encryption scheme, considerable computational resources and skills are required. An authorized recipient can easily decrypt the message with the key provided by the originator to recipients but not to unauthorized users.

What is Credit Card Encryption?

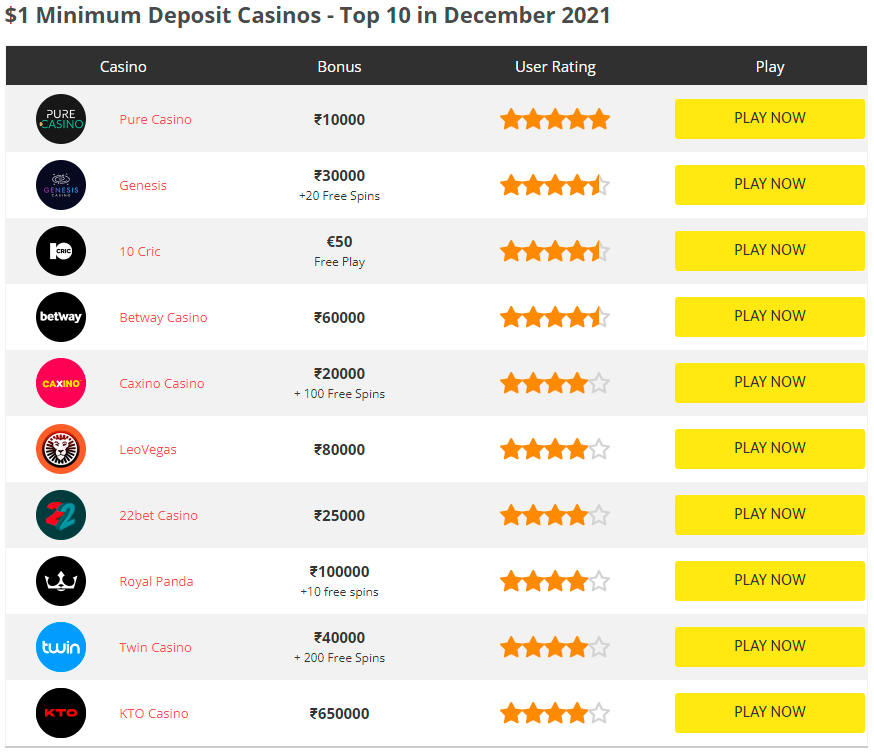

Credit card encryption is a security measure used to reduce the likelihood of credit or debit card information being stolen. Credit card encryption involves both the security of the card, the security of the terminal where a card is scanned, and the security of the transmission of the card’s information between the terminal and a back-end computer system. Click here for $1 deposit casino .

How Credit Card Encryption Works?

When a credit account holder makes a purchase with their card, the information such as the account number is scrambled by an algorithm. The intent is to make it impossible to access that information without the corresponding encryption key that lets the merchant and financial institution conduct their transactions. Until the information is decrypted by the key, the information is not usable, making it safe so long as it remains locked.

Things That Prove Your Payment Processing Is Secure:

What makes online payments secure?

It is almost impossible to eliminate fraud, but there are many ways to secure your data and prevent them from being stolen. Read below to find out what to focus on to ensure that payment processing on your website is secure (or what to consider when choosing a payment gateway for your online business in case of security).

- SSL for secure connections

- PCI certificate

- Tokenization

- 3D Secure authentication

- Anti-fraud tools

How to Make Secure Online Payments?

The number of online shoppers has doubled since 2014, with over 25% of people worldwide paying for products and services online. The convenience of online payment methods is undeniable, so why aren’t even more people embracing Internet shopping? One of the main reasons is security. According to stats, the Internet users concern about online security threats is increasing.

To combat cybersecurity issues, ecommerce shop owners and online payment providers (banks, credit card institutions, payment processors, etc.) are continually improving their online security technologies and regulations.

What Is the Safest Method for Online Payments?

- Credit Cards

- Debit Cards

- E-Wallets

- Prepaid and Gift Cards

- Wire Transfers

Credit Cards:

Credit cards have the longest history of use, with some of the strongest financial institutions behind them. These institutions have rigorous regulations about data security measures, and each country has its own data protection laws.

Credit card issuers offer the following payment authentication and general security measures for online shoppers:

- SMS code

- Encryption protection

- 3D-secure

- Tokenization

Debit Cards:

Debit card providers offer the same type of 3D security measures for online payments as credit card institutions.

- Debit card users’ liability for a stolen or misused card is $50 only if users report it within 48 hours. Credit card users’ liability is $50 regardless of when they report the unauthorized card use.

- Credit card holders can open disputes about damaged products with their card issuer and quickly get refunds. Debit card users can only settle disputes with merchants.

E-Wallets:

Electronic wallets are digital payment methods. They have gained popularity with the increase in online payment processing.

E-wallets are a convenient payment method because you can:

- Enter credit or debit card information and draw funds from those accounts when paying with the e-wallet.

- Transfer cash to your e-wallet to make payments.

- Use the money someone transferred to your e-wallet directly, without going through a bank account.

- Pay with just several clicks.

Prepaid and Gift Cards:

Prepaid and gift cards can be used the same way as credit cards. They don’t have the same safety regulations as credit cards, but the U.S. Consumer Financial Protection Bureau implemented new regulations for protecting prepaid card owners a few years ago.

Wire Transfers:

Wire transfer is an electronic payment method that involves transferring money from one entity’s bank account to another. Some merchants prefer them to other online payment methods.

How to Ensure the Security of Online Payments?

You can also contribute to making your online payments more secure.

- Check whether the website you’re buying from has a SSL certificate. If it does, you’ll see a padlock icon in the address bar (top left corner of your browser).

- Check whether the URL starts with https (NOT http).

- Always update your mobile or desktop device software.

- Don’t access your e-wallets or input your credit/debit card info when you’re using a public Wi-Fi connection.

- Keep receipts of online payments you make and double check your transactions.

- Use additional verification steps that your payment providers offer (additional one-time passwords, codes sent to SMS, eye recognition software, etc.)

- Pay with a prepaid card because it isn’t linked to your personal bank account