cheap car insurance in sc - Top 10 best car / auto insurance list in South Carolina - car insurance quotes sc

About South Carolina, United States - cheap car insurance in sc

- South Carolina is a state in the southeastern region of the United States.

- The state is bordered to the north by North Carolina, to the south and west by Georgia across the Savannah River, and to the east by the Atlantic Ocean.

- South Carolina became the eighth state to ratify the U.S. Constitution, doing so on May 23, 1788.

- South Carolina Capital City : Columbia.

- South Carolina Nickname : Palmetto State.

- Capital Tour : South Carolina Capital Tour.

- South Carolina Flag : William Moultrie chose a blue which matched the color of their uniforms and a crescent which reproduced the silver emblem worn on the front of their caps.

- South Carolina Flower : Yellow Jessamine (Gelsemium sempervirens).

- South Carolina Largest Cities : Columbia, Charleston, North Charleston, Mount Pleasant, Rock Hill, Greenville, Summerville, Sumter, Hilton Head Island, Florence.

- South Carolina Origin of State Name : Taken from Carolus, the Latin word for Charles, and named after England's King Charles I.

- South Carolina Population (2013) : 4,774,839.

- South Carolina Rank : 24 of 50.

- South Carolina Area : 32,007 sq. mi (82,898 sq.km.), 40th.

- South Carolina Land : 30,111 sq. mi. (77,987 sq.km.), 40th.

- South Carolina Water : 1,896 sq. mi. (4,911 sq.km.), 21st.

- South Carolina Coastline : 187 mi. (301 km.), 11th.

- South Carolina Shoreline : 2,876 mi. (4,628 km.), 11th.

- South Carolina Border States : Georgia, North Carolina, List of US Regions.

- South Carolina Geographic Center : Richland, 13 miles southeast of Columbia.

- South Carolina Highest Point : Sassafras Mountain ; 3,560 feet, (1,085 m.), 29th tallest.

- South Carolina Location : Absolute Center: 33°49.8'N / 80°52.4'W.

- South Carolina Relative Center : Richland, 13 miles southeast of Columbia Distance Between U.S. Cities.

- South Carolina Lowest Point : Atlantic Coast ; sea level, tied for 3rd lowest.

- South Carolina Museums :

- The Charleston Museum (Charleston).

- Columbia Museum of Art (Columbia).

- South Carolina Confederate Relic Room & Military Museum (Columbia).

- State Parks : South Carolina State Parks.

- South Carolina Agriculture : Tobacco, poultry, cattle, dairy products, soybeans, hogs.

- South Carolina Industry : Textile goods, chemical products, paper products, machinery, tourism.

- South Carolina has a humid subtropical climate although high-elevation areas in the Upstate area have fewer subtropical characteristics than areas on the Atlantic coastline.

- The highest recorded temperature is 113 °F (45 °C) in Johnston and Columbia on June 29, 2012, and the lowest recorded temperature is −19 °F (−28 °C) at Caesars Head on January 21, 1985.

- According to the U.S. Bureau of Economic Analysis, South Carolina's gross state product (GSP) in current dollars was $97 billion in 1997, and $153 billion in 2007.

- South Carolina also benefits from foreign investment. There are 1,950 foreign-owned firms operating in South Carolina employing almost 135,000 people.

- Foreign Direct Investment (FDI) brought 1.06 billion dollars to the state economy in 2010.

South Carolina Minimum Liability - cheap car insurance in sc

- Bodily Injury

- $25k per person

- $50k per accident

- Property Damage

- $25k per accident

- $50,000 per person for bodily injury and

- $100,000 per accident.

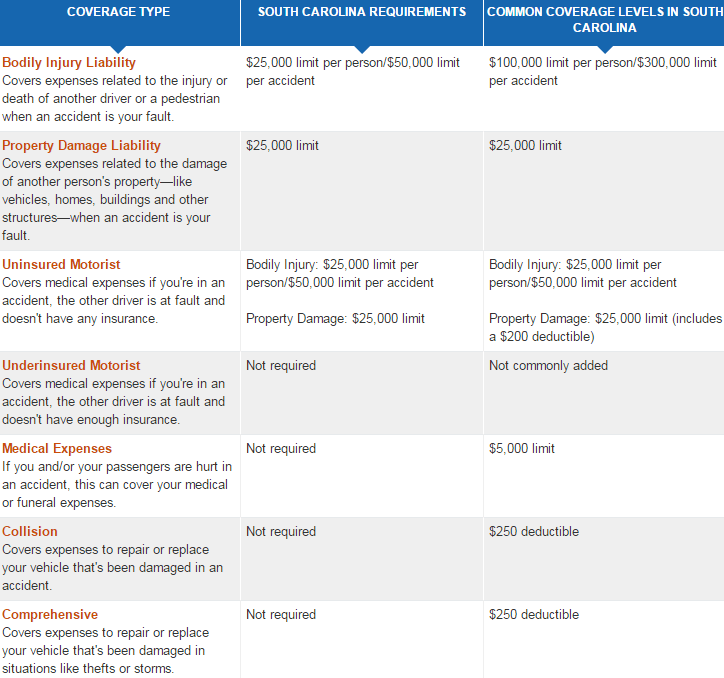

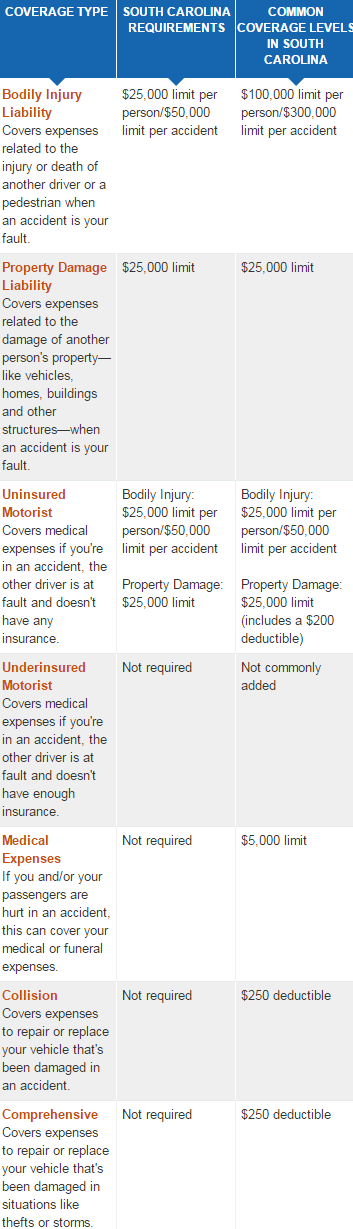

Minimum Requirements for Auto Insurance Coverage in South Carolina

| Type | South Carolina Minimum Requirements | Study Limits |

| Bodily Injury Liability | $25,000 per person, and | $50,000 per person, and |

| up to $50,000 per accident | up to $100,000 per accident | |

| Property Damage | $25,000 per accident | $25,000 per accident |

| Uninsured Motorist | $25,000 per person, and | $50,000 per person, and |

| up to $50,000 per accident | up to $100,000 per accident |

South Carolina car insurance Details - cheap car insurance in sc

- Getting the best and cheap car insurance quotes is really important. In south-carolina, you're legally required to have the car insurance coverage at the levels listed in the chart below.

- Once you're familiar with the basics, take a look at the common coverage levels of Wikitechy policyholders in south-carolina. Many car insurance companies are competiting.

- It's a great way to get a sense of cheap liability auto insurance and the vehicle insurance rates depends on the vehicle insured.

- Your agent can help you understand the different full coverage car insurance types and you can collect car insurance quotes available in your state.

- Then you can decide cheap car insurance and also insurance agent to be preferred or not what limits and deductibles best fit your needs. As your life changes, your vehicle insurance rates should, too.

- Your agent will be there to discuss your options and help you find ways to save on your premium.

- Wikitechy also provides you with helpful information so you can better understand car insurance and car insurance quotes can be taken online and rest easy knowing you're protected.

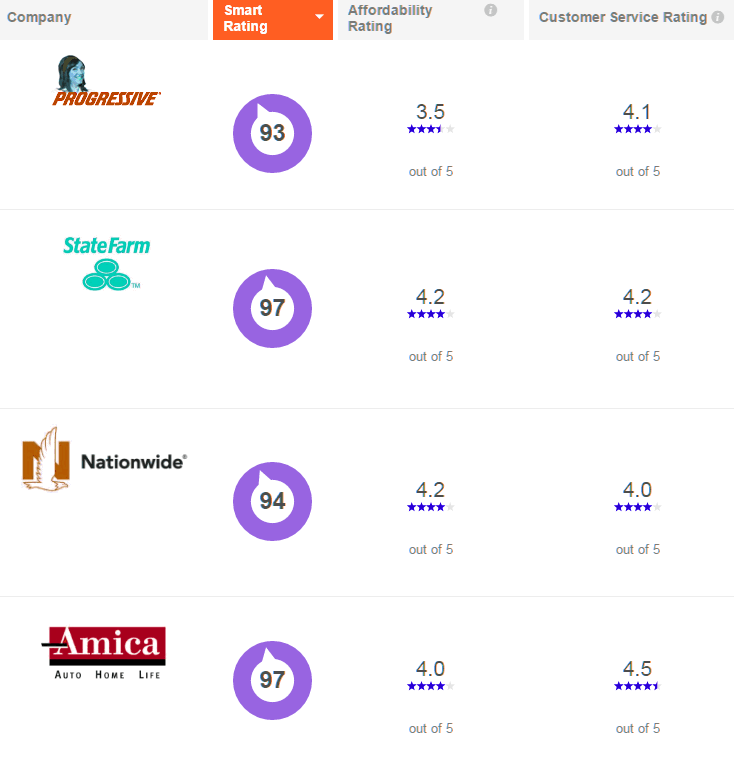

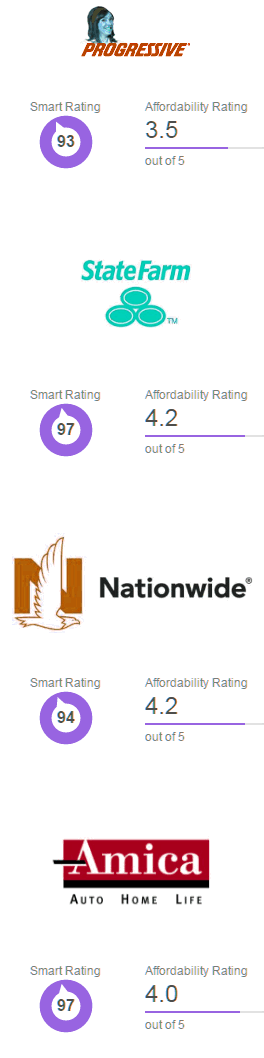

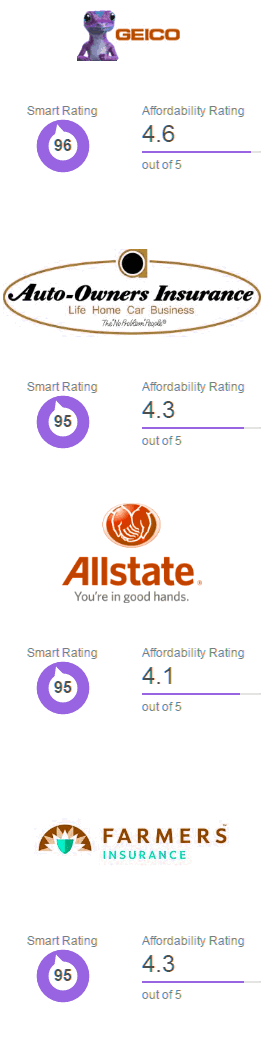

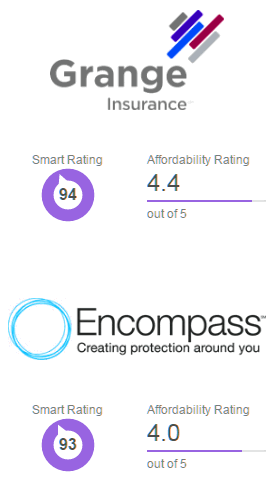

cheapest auto insurance in south carolina - auto insurance quotes sc

Common Terms in car insurance quotes - cheap car insurance in sc

- Below are of some of the terms for travel insurance and travelers insurance ,

- car insurance Adjuster - The person from your car insurance companies who investigates and evaluates your damage and losses.

- insurance agent - An individual or organization licensed to sell and service insurance policies for an auto insurance companies.

- insurance broker - Fee Agreement - The contract between you and your broker. It lists the fees for your broker's services

- insurance Cancellation - When you or your insurance company ends your policy early. They might do this because you did not pay your premium. You might cancel your policy because you are no longer own or drive a car.

- insurance claim - Your request to an insurance companies to cover an accident or other loss.

- full coverage car insurance - Pays for damage to your car caused by physical contact with another vehicle or an object, such as a tree, rock, guardrail, building, or person. insurance coverage makes you to get the loss of your property

- Commission - The fee that an insurance company pays an agent or broker when they sell a policy

- Comprehensive coverage - Pays for damage to your car caused by something other than a collision, such as fire, theft, vandalism, windstorm, flood, falling objects, etc.

- Deductible - The amount of the loss that you must pay before your insurance company pays anything. Only comprehensive and collision coverage have deductibles.

- Gap coverage - This pays the difference between the fair market value of your new car and the balance you owe on your loan or lease.

- Insured - The person who can receive covered benefits in case of an accident or loss. Also called the policyholder.Addition to the "car insurance" the policyholder will be advised to take "life insurance" too.

- car insurance companies - Insurer - The company that issues your insurance. compare car insurance to look for the "cheap insurance" companies. auto insurance companies will provide you the auto insurance quotes to you. If you feel it's a "best auto insurance" company go ahead with them.

- Liability coverage - car insurance that helps pay for the injuries and damage to others from accidents that are not your fault. affordable insurance and comprehensive car insurance are key factors you need to check for the getting insurance.

- Surcharge - An extra charge that is added to the premium by an insurance company. This usually happens because a covered driver has had an accident or moving violation that is their fault.

- Subrogation - When one insurance company pays money on a claim, and then tries to get paid back or reimbursed by another insurance company

- Declarations page - Usually the first page of an insurance policy. It lists the full legal name of your insurance company, the amount and types of coverage, the deductibles, and the vehicle(s) insured.