PayPal has become the same with online payments and this usually popular platform shall we users make financial transactions, completely putting off the need for bank transfers and checks. This free payment processing service only requires the presence of a valid PayPal account on both the receiver and the sender’s end. The most important upside to PayPal is its widely-recognized platform and how easily it manages to integrate with different third-party platforms and carts.

[ad type=”square”]Fees: No matter the reality that price may additionally according to payment methods you use, one of the disadvantages of PayPal is the high fee.

Holding Payments: PayPal holds your price and places it under review with no proper reason.

Some countries are not supported by PayPal such as Iraq, Bangladesh, Pakistan, Afghanistan etc.

Country-based restrictions on use of PayPal

1.Google Wallet

Google Wallet is the new way of sending, receiving and paying cash online. But, now it is available only in the United States. We can use Google Wallet to store credit cards gift cards, debit cards and loyalty cards in a digital wallet and use it for sending and receiving cash from friends or family in addition to a manner to pay money online. To send money online to your friends or family using their email address or as a Gmail attachment, and you can fund the money from Google Wallet balance, bank account, debit card and/or credit cards. Now, we can circulate directly to the pros and cons of Google Wallet.

Pros

- Single card instead of different debit and credit cards

- It is from Google, and that’s a big advantage.

- 24*7 Fraud Monitoring and purchase protection

- Tight integration with Google account

Cons

- Less Acceptance as compared to PayPal and availability is restricted to US.

Commission

Google Wallet is free. But, you have to pay standard transfer charges when you are using credit card/debit card to transfer money into your Google Wallet account.

Where does Google Wallet Work

Unfortunately, Google Wallet and its features like money transfer, purchasing in stores are available only in US. But, we will be able to use Google Wallet over 125 countries to buy products from Google Play Store.

When checking cons of Google Wallet, it can become a superpower in web-based payment sector if it expands its acceptance.

PayPal Alternative: Top 10 Services to Make Online Payments

2.Skrill

Skrill is a typical alternative for PayPal. Skrill was formerly known as Moneybookers, is a platform to send and receive money and shop online. The usage of this platform, a user can send money to an email ID, which belongs to another Skrill user. Also, the recipient can withdraw cash via credit card, debit card or bank account etc. Skrill allows instant withdrawal into the bank account of recipient. Merchant fees of Skrill are comparatively low and we can realize more about costs on official website of Skrill. And also, Skrill is globally available.

Pros

- Top-level Security

- Wide acceptance

- Low transaction fees

- It Support over 200 countries and we can use Skrill in 40 currencies.

- Skrill Prepaid MasterCard lets we can use money in Skrill account to purchase in real life

Commission

Cost plan of Skrill is impressive and Skrill takes 1% of sent money as commission. So, if send €100, commission will be €1. Until now, most amount of commission has been fixed on 10 Euros. In addition, charges to transfer cash from your bank to Skrill are almost free if using SWIFT Transfer technique. In case of credit cards or debit cards, you will have to pay general costs.

Where does Skrill Work

Skrill provides supports in around 200 countries, with ability to manage account and send money in 40 currencies. But, it should be noted that earlier, US was not in supported list of Skrill. But now, United States is included in the list of supported countries by Skrill.

Overall, Skrill is the best alternative for PayPal in both aspects as a money transfer platform and web payment.

PayPal Alternative: Top 10 Services to Make Online Payments

[ad type=”banner”]

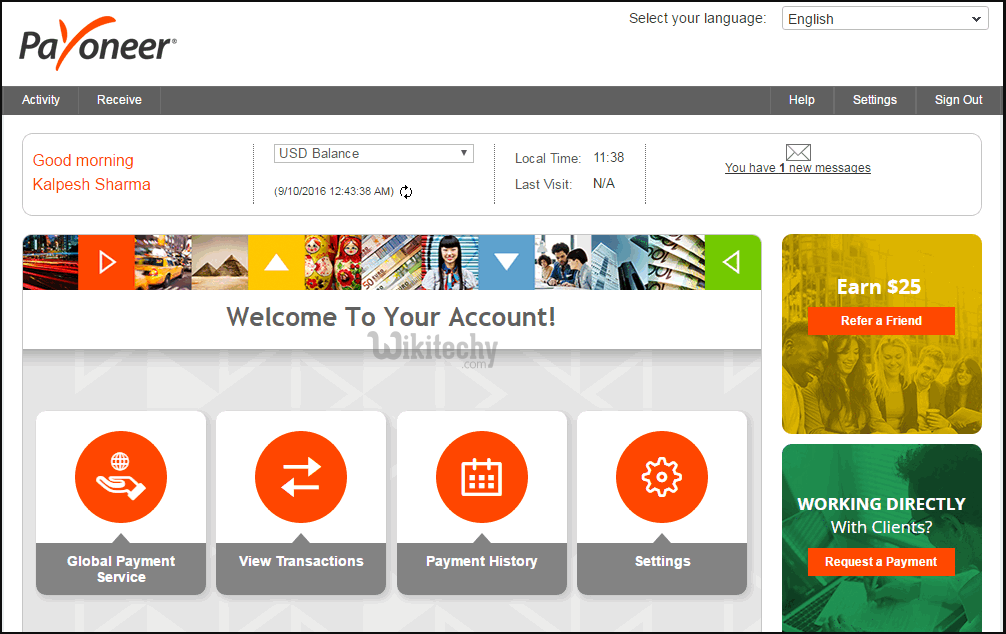

3. Payoneer

It is the best choice for experts, which includes freelancers and affiliate marketers, who need to receive money from different countries. While companies use Payoneer as a payment method along with wire transfer and others, users can use this platform to get payments from any part of globe. Users can get funds in different ways. Payoneer gives two different methods to use received funds. Through local bank transfer or global transfers or Payoneer reloadable credit card. And additionally, you have an option to transfer amount to another Payoneer user.

Pros

- Process transactions in more than 100 currencies.

- Huge acceptance

- Available in 200 countries

Cons

- Rent of credit card is a bit high

Commissions

Transfer fees of Payoneer depend upon the country you live and in which currency you process your transactions. In addition, there will be a moderate charge when you use your Payoneer Credit Card through an ATM to use your price range.

Where does Payoneer Work

Payoneer works in more than 200 countries and is able to processing transactions in around 100 currencies. Payoneer is an outstanding solution when it comes to processing worldwide transactions regardless of the reality that service is not available in few countries such as India.

PayPal Alternative: Top 10 Services to Make Online Payments

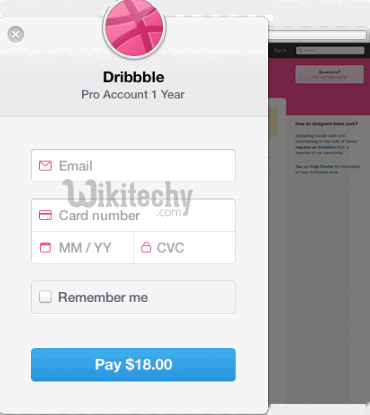

4. Stripe

Stripe is another simple way to accept payments from your customers. Stripe is a workable alternative to PayPal as far as easier acceptance of payment is concerned. Stripe accepts a several payment methods including cards such as Visa, MasterCard, American Express and JCB. Additionally, Stripe can process transactions in around 100 currencies.

Business should be based in Canada, UK, Australia, United States, Ireland, Australia, Belgium, Finland, France, Germany, Luxembourg, Netherlands, Spain, Denmark, Norway, Sweden, Austria, Italy and Switzerland to receive payments from Stripe.

Commission:

For every successful transaction, Stripe will charge 2.9%+$0.30 as its commission. Transactions of profits are processed through a 2-day rolling basis.

Pros

- Integrated mobile payments

- Payment can be sent from any country

- Simple Setup using Plugins

Cons

- Now Stripe supports only 19 countries.

PayPal Alternative: Top 10 Services to Make Online Payments

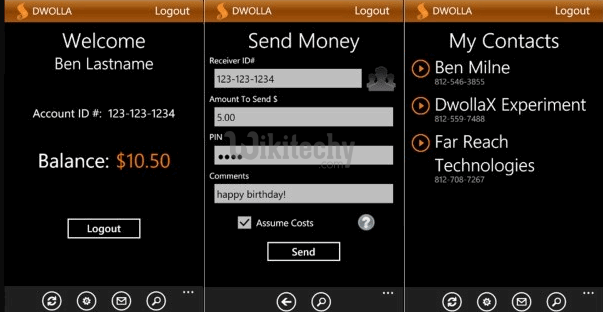

5. Dwolla

Dwolla is another alternative for PayPal, as a payment service and a platform to send money to anyone on internet. If normal users can use Dwolla to make online payments and sending or receiving money, business owners can make use of Dwolla by using the platform to receive money from their customers. Using Dwolla, it is possible to send money to email addresses, LinkedIn connections, Twitter followers, phone numbers and businesses that accept Dwolla. Another feature of Dwolla is Dwolla MassPay, which lets process thousands of payments at a time.

Pros

- Get rid of risks of identity theft, as you’re sharing only email address and phone number

- Easier methods of clearing payments

- It’s a free service and transaction fees are incredibly low

- Simple User Interface and support for Android and iOS

Cons

- Transferring money from Dwolla to bank account may take up to 2 to 3 days.

- No linking with credit cards or debit cards

- when compared to PayPal, acceptance is pretty low

Commission

Unlike PayPal, you’ve to pay only $0.25 for each transaction, despite the fact that transaction is free if amount is less than $10.

Where does Dwolla Work

Now, Dwolla is available only in the United States and you must have a valid US Mailing address & SSN to use Dwolla. Furthermore, US bank accounts only can be linked to Dwolla

Dwolla is trying to launch its service in other countries, availability only in US of the service is a noticeable problem.

PayPal Alternative: Top 10 Services to Make Online Payments

6. 2Checkout

2Checkout is a partial PayPal alternative, because it does not allow transfer of money in between users. Instead, dealers shall use 2Checkout as an actual way to process transactions when they sell items. Now, 2Checkout supports eight payment methods, including Visa, MasterCard, JCB, PIN Debit cards, and PayPal. Additionally, 2Checkout works with 26 currencies and integrate it with a wide range of shopping carts such as Shopify, ZenCart, Ecwid and 3DCart.

Commission:

2Checkout charges 2.9%+$0.30 per transaction if you are from US and 5.5%+$0.45 otherwise

Pros

- Automatic fund release via EFT

- Smartphone Applications to keep track of numbers

Cons

- It does not allow transfer of payment between users.

- 2Checkout is the best PayPal alternative for dealers. It is available in 196 countries through 8 payment methods, 26 currencies and 15 languages.

PayPal Alternative: Top 10 Services to Make Online Payments

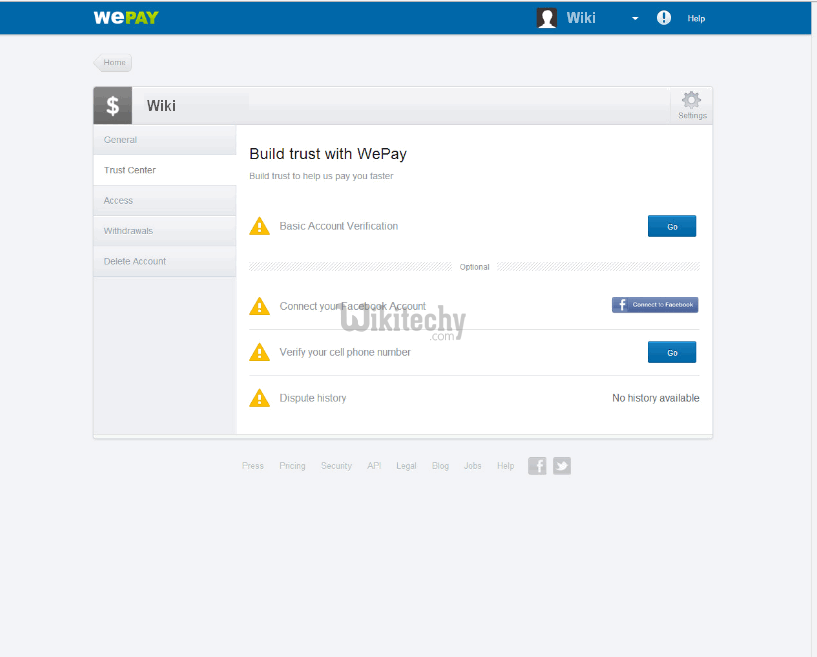

7. WePay

Implementing WePay in your site means setting up a method for customers to pay without leaving your site. WePay creates a virtual terminal in order to process payment. Since it is an API-based technology, you must have technical knowledge in order to implement WePay. Although the service keeps simplicity in all aspects, some features of WePay are very attractive. The above-mentioned platforms, WePay, though it supports most of international cards, is available for customers from US and have a US SSN and billing address.

WePay payment API focuses exclusively on platform businesses such as Crowd-funding sites, small business software and marketplaces.

Commission:

WePay charges 2.9%+$0.30 in credit card payments, bank payments will be charged 1%+$0.30.

PayPal Alternative: Top 10 Services to Make Online Payments

8. Selz

Selz is another alternative for PayPal for dealers and small businesses. It’s a great way to accept payments from customers. Selz is a suitable choice for suppliers as well as bloggers, who do sell something through their website. This service is being used by a number of professional bloggers and other web-based professionals. If we have a WordPress site/blog, we can use Selz WordPress plugin to install it. When compared to PayPal and other payment methods, Selz suits selling digital products. we will be able to transfer amount to your bank account or PayPal.

Commission:

For each transaction made through Selz, it will charge a commission of 5%+$0.25.

Pros

- Support for 190 currencies

- Suits digital downloads

- Easy-to-use interface

However, Selz is not available in countries such as Vietnam, Indonesia, India, Pakistan and Nigeria as well as the countries, which are not supported by PayPal.

PayPal Alternative: Top 10 Services to Make Online Payments

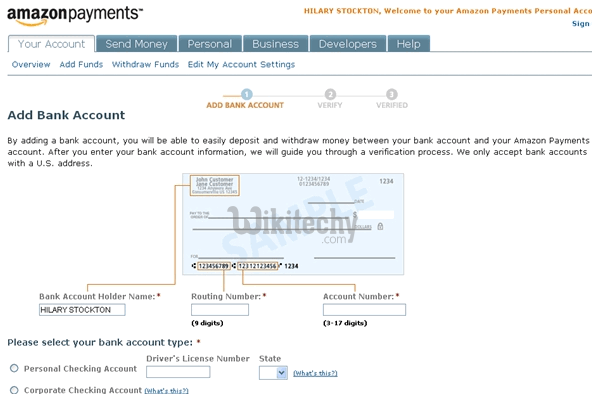

9. Amazon Payments

Amazon Payments is another option to PayPal, and it comes from a web giant – Amazon. Even though we can take it as a single platform for processing money transactions online, there are different classifications in Amazon Payments that suit different users such as customers, businesses and of course, developers. Online purchases section of the service is made to simplify purchasing task, by using payment methods we have added in our Amazon.com account. Therefore, we can skip that task of reentering payment details as well as shipping addresses. On the other hand, WebPay from Amazon Payments lets users send and receive money.

Pros

- Comparatively wide acceptance

- Integration with Amazon.com

Cons

- Amazon WebPay is not available for non-US residents

- High duration for money withdrawal from Amazon WebPay to your bank

Commission

Amazon Payments is completely free from the users’ point of view. Using Amazon WebPay, users can send money by paying nothing as well as receiving money from others. Up till now, they will have to pay transaction fees if they withdraw amount through credit card or debit card. However, when it comes to dealers’ viewpoint, the commission is a bit high, as Amazon Payments charges based on a rate of 2.9%+$0.30. But, Amazon offers volume discounts as well as non-profit discounts.

Where does Amazon Payments Work

Amazon WebPay is currently available in United States. Similarly, when it comes to Checkout by Amazon, it is more complex, because Checkout by Amazon is available for merchants in US. These merchants should have one US-based street address, phone number and credit card.

Overall, Amazon Payments is an optimum choice for both users and merchants, despite its restricted availability. We do Amazon Payments will expand its operations to other countries as well.

PayPal Alternative: Top 10 Services to Make Online Payments

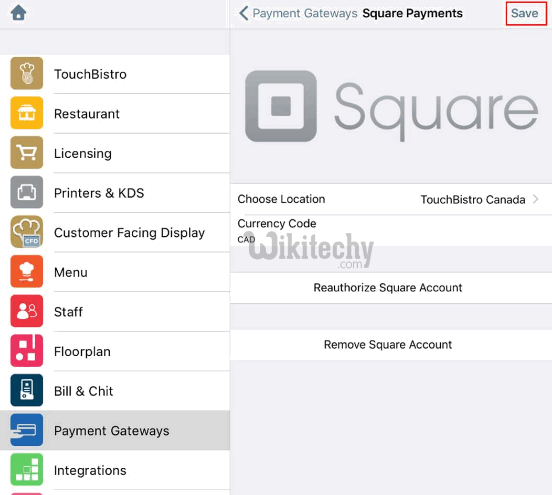

10. Square

Square is a PayPal alternative with a twist. Square will provide a card reader that will work perfectly with your iPad, iPhone or Android Smartphone. In addition, Square lets users create an online store, from which customers can make purchases. Visa, MasterCard, Discover, American Express are supported by Square card reader.

Commission:

Square charges 2.75% of total amount of money that is transferred. By the way, Square Reader is only available for US and Canada.

PayPal Alternative: Top 10 Services to Make Online Payments